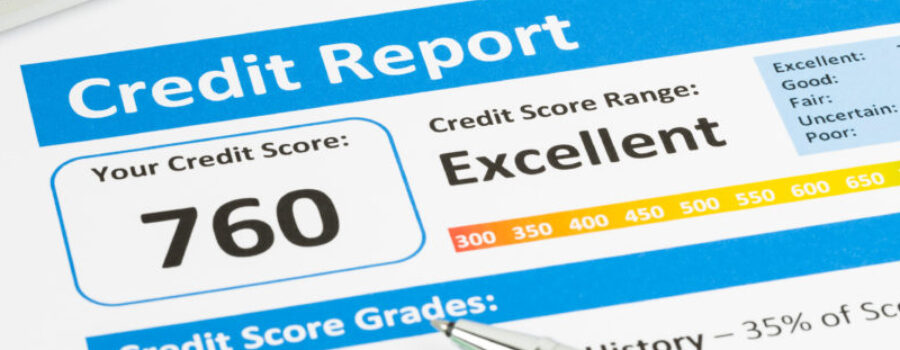

Your credit report is a record containing your personal information and credit history. Creditors, banks, insurers, and even employers can request access to your credit report from a credit bureau. They can then use your credit report to evaluate how you manage debt, whether or not you make your payments on time, and how much credit you have. This information will help them decide whether or not to approve you for a loan and what kind of interest rates to give you.

What’s Included in a Credit Report?

A credit report normally includes your personal information, information about your credit accounts, any credit inquiries, and public record/collections information.

Personal information can include your name, address, social security number, date of birth, and place of employment.

Credit inquiries are made anytime someone asks for a copy of your credit report. In this section, your credit report shows anyone who ever made an inquiry within the last two years, including yourself. Soft inquiries can take place without you knowing. For example, a credit issuer will check your credit report so they can send you a pre-approved card in the mail. A hard inquiry, on the other hand, requires your consent.

Account information will detail your credit history. It will likely include a list of all loans you’ve taken out, the balance left on those loans, what type of loans they are (home, auto, etc.), and your payment history (whether or not you make your payments on time and in full).

Public records listed in your credit report include information from state or county courts and collection agencies. The report will show any time you’ve been sued, declared bankruptcy, or foreclosed on a home, as well as any liens, wage attachments, judgments, or overdue debt.

Where Can I Get a Copy of My Credit Report?

Every year, you can request one free copy of your credit report from each of the three major credit agencies in the U.S., namely Equifax, Experian, and TransUnion. You can do this online, by mail, or by calling 1-877-322-8228. If you order your report online, you should get it immediately, while if you order it via mail or phone, it may take 15 days for the report to be processed and sent out.

You’ll also have to verify your identity with the agency by giving them your name, address, date of birth, and social security number. You may also be asked to provide a piece of private financial information, like how much you pay each month on your mortgage, just for a little added security.

Besides your annual entitlement, you may also be entitled to a free report if you’re denied employment based on your credit. This entitlement lasts 60 days after you receive the notice from your employer. (Employers are required to send you a notice if their decision not to hire you was influenced by your credit history.) You could also be entitled to a free credit report if you’re on welfare, or if you’ve been a victim of fraud or identity theft and need to dispute charges.

Why Should I Check My Credit Report?

You’ll want to check your credit report at least annually just to make sure everything is accurate and up-to-date. This report is going to largely determine whether or not you get approved for a loan and what kind of interest rates you’ll get. So don’t let anything fixable keep you from saving money or getting that house you want. Checking your credit report can also alert you to possible identity theft and give you time to make changes before serious damage is done.

Beware of Scams!

AnnualCreditReport.com is the only site authorized by law to send you a free annual credit report from the credit agencies we listed above. Additionally, neither this site nor any nationwide credit agency will send you emails asking for your personal information. As a rule, never give out your personal information via email unless you are positive the request comes from a legitimate source.

For tons more information on credit, including how to improve your credit score, visit this page or give us a call at 866-569-8272. We’ll be happy to answer your questions.

1 Comment

Leave your reply.